|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gap Program for Cars: Coverage GuideWhen it comes to owning a car in the U.S., unexpected repair costs and depreciation can be a significant burden. This is where a gap program can offer peace of mind. Designed to bridge the gap between what you owe on your vehicle and its current market value, a gap program can save you from potential financial strain. Understanding Gap ProgramsA gap program is a type of vehicle protection that covers the difference between your car's depreciated value and the amount you still owe on your loan or lease. This is especially beneficial in the event of theft or total loss. Why You Need It

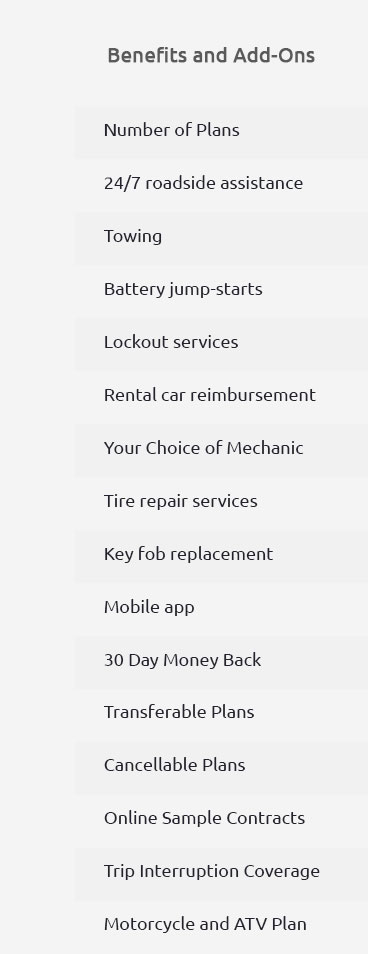

For more details on extending your car's protection, check out this vehicle protection program. What Does It Cover?The coverage provided by gap programs can vary, but typically includes:

These benefits are crucial for anyone looking to protect their investment in states like California and Texas, where auto theft rates are notably high. Cost ConsiderationsThe cost of a gap program can depend on several factors, including the vehicle's age and model, loan term, and the insurer. In general, it's a small price to pay for substantial protection, particularly when compared to potential out-of-pocket expenses. Is It Worth It?Absolutely! For those driving in urban areas like New York City, where accidents are more common, the security offered by a gap program far outweighs its cost. For more tailored warranty solutions, consider looking into a tyger auto warranty. FAQ

In conclusion, a gap program for cars is an invaluable tool for anyone financing a vehicle. It provides peace of mind and financial security, ensuring that you're not left out of pocket if the unexpected occurs. Whether you're driving through the bustling streets of Los Angeles or the quiet roads of rural America, having a gap program is a smart decision for savvy car owners. https://www.penfed.org/auto/guaranteed-asset-protection

How GAP works - Standard auto insurance reimburses you for a car's current value, not what you still owe on your loan. - The gap: If your loan amount is higher ... https://www.toyotafinancial.com/us/en/vehicle_protection_plan/guaranteed_auto_protection.html

Filling the GAP. Your current auto insurance may not be enough if your vehicle is declared a total loss. - Total Loss Protection - Deductible Coverage. https://www.caranddriver.com/car-insurance/a31263168/what-is-gap-insurance-on-a-car/

You can add GAP coverage to any State Farm auto policy. Allstate's GAP program waives the difference between a primary auto insurance settlement and the ...

|